Solar Panel Uptake: A Savior or A Recipe for Disaster?

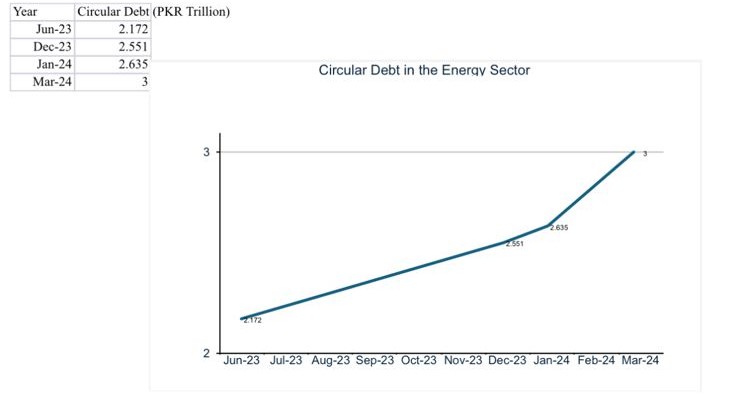

Pakistan has been dealing with an energy crisis for nearly two decades now. Frequent power outages, soaring electricity bills, high transmission and distribution (T&D) losses, electricity theft and non-payment issues, and inefficient distribution networks have made matters worse. Alongside the widening gap between electricity supply and demand, the country faces a growing circular debt, which surged to PKR 2.636 trillion in January 2024, an increase of PKR 84 billion since December 2023.

In March 2024, Pakistan's total installed electricity capacity stood at approximately 42,131 MW, while total electricity consumption reached 68,559 GWh, reflecting a significant disparity of 137.34%. This gap has led to severe electricity shortages, contributing to the repeated increases in electricity prices. Between July 2023 and August 2024, prices surged 14 times, with the largest increase of PKR 7.06 per unit occurring in March 2024. As the cost of electricity continues to rise, the adoption of solar panels has grown considerably, offering a potential cost-effective solution for households and businesses across the country.

Amidst the growing interest in solar panels, the energy sector is now facing a new set of challenges. This blog post highlights the recent uptake of solar panels across Pakistan, explores the potential benefits and drawbacks of this shift, and focuses on whether it can help alleviate the energy crisis and address the circular debt issue.

Solarization on the rise in Pakistan

Since 2021, electricity prices have surged by approximately 155%. Currently, the per unit cost of electricity for domestic consumers is PKR 62, while industrial consumers face a rate of about PKR 65.

In 2024, solar panel prices dropped by nearly 50% in just a matter of 12 months due to a surge in imports and increased supply relative to consumption in the country. This price drop, along with the government’s initiative to boost the renewable energy sector and the removal of taxes on imported solar panels, have made solar panels more affordable than ever.

Hence, a rapid uptake of rooftop solar panel systems among residential, commercial and industrial consumers has been seen, providing a viable option to lower energy costs. By March 2024, there were 117,807 solar installations utilizing net metering, collectively generating 1,822 MW of power, a drastic increase from 630 MW in 2023. Additionally, the number of certified installers actively operating exceed 400 in 2024.

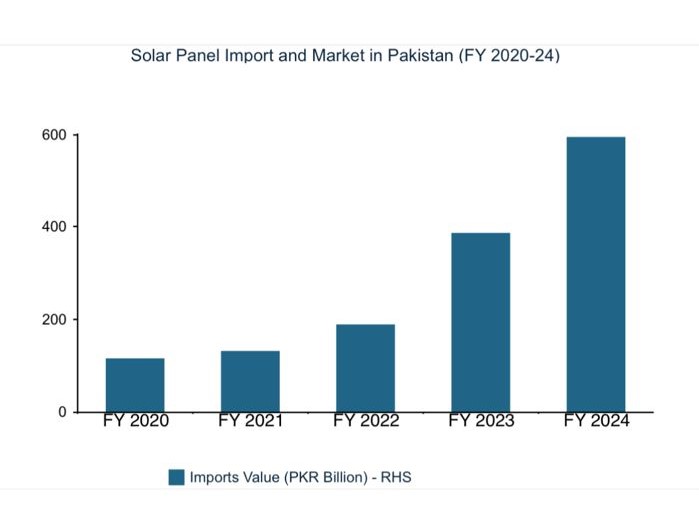

Figure 1 illustrates the trend of solar panel imports and installed capacity in Pakistan from 2020 to 2024. The import value reflects a steadily expanding solar market, rising from PKR 115 billion in 2020 to PKR 592 billion in 2024. Meanwhile, the installed capacity has surged from 5 GW in 2020 to 30 GW in the first few months of 2024, indicating a significant increase in solar energy adoption during this period.

Figure 1: Panel Import into Pakistan and Solar Panel Market, 2020-24. Source: State Bank of Pakistan

Moreover, Pakistan is projected to achieve a solar capacity of 22-27 GW by the end of 2024, with the bulk of installations expected to come from the residential and industrial sectors. This capacity will be sufficient to produce approximately 30,000 GWh of electricity annually, accounting for 3.6% of the country’s yearly electricity demand.

Impact of Solar Panel Adoption on the Energy Sector

Investing in solar panels is increasingly viewed as a financially sound decision, as the long-term benefits outweigh the initial costs. It marks a move towards cleaner energy alternatives, which is crucial for a country like Pakistan that is already battling climate change impacts. Additionally, it offers a shift away from imported fossil fuels, leading to a sustainable way to meet energy demands and reduce the foreign exchange burden.

Solar panels also provide a viable solution for electrifying remote and rural areas of Pakistan where extending the grid may be economically unfeasible, improving access to electricity for underserved populations. For instance, the 100 MW Solar Plant in Layyah provides clean energy to approximately 50,000 households and feeds 120 million units into the national grid.

However, as more consumers transition to solar power, the demand for grid-supplied electricity diminishes, while the fixed costs associated with power generation and infrastructure remain relatively constant. This disparity results in higher tariffs for the remaining grid-connected consumers, as these costs are distributed across a smaller user base, leading to additional financial strain on the already inflation-stricken population of Pakistan.

This situation is exacerbated by the financial load created by capacity payments to Independent Power Producers (IPPs), which the government has to make regardless of electricity use. As more people switch to solar power, these capacity payments have increased from PKR 16.22 per kWh in 2023-24 to PKR 17.31 per kWh in 2024-25, while the annual loss due to reduced demand for grid-supplied electricity is projected to be PKR 8.83 trillion. This puts additional pressure on the national budget and forces consumers to pay higher electricity rates to cover these expenditures.

Consequently, this cycle also lowers revenues for Distribution Companies (DISCOs). The recovery ratio—representing the proportion of electricity bills successfully paid by consumers—stood at 92.4% in 2022-23 but dropped to 73.9% in 2023-24, highlighting the increasing difficulty in maintaining financial stability in the energy sector.

Finally, solar energy production is intermittent, varying with weather and time of day. This unpredictability can complicate grid management. Existing grid infrastructure may not be equipped to handle the influx of distributed solar energy, requiring upgrades and modifications.

Impact on Circular Debt

The circular debt in Pakistan's power sector has been steadily increasing, rising from PKR 2.551 trillion in December 2023 to PKR 3 trillion by March 2024, growing by an average of PKR 66.14 billion per month, as shown in Figure 2. One of the key drivers of this escalating debt is the inefficiency of DISCOs, primarily due to low revenue recoveries caused by falling electricity demand and frequent electricity theft, and high T&D losses, which surged by 19% in the first seven months of 2024. Additionally, delayed payments to IPPs and elevated generation costs exacerbate the problem.

Figure 2: Circular Debt Accumulation (PKR Trillion), Jun 23-Mar 24. Sources: World Bank & Center for Research & Security Studies

While these issues have long been present, the increasing shift towards solar panel adoption has intensified the problem. Any savings households and industries may have achieved by installing solar panels are effectively cancelled out by the increasing circular debt, which ultimately falls on the Pakistani consumer. Consequently, the overall financial effect of widespread solar panel adoption has become a net loss for the country.

Can Solar Solve the Energy Crisis in Pakistan?

While solar energy presents a promising solution to Pakistan's energy crisis, it cannot solely address the multifaceted challenges inflicting the energy sector.

The government must accelerate structural reforms to address fundamental issues within the energy sector. This includes improving the governance of DISCOs, integrating captive power demands into the electricity grid, and reforming the payment mechanisms for IPPs. If implemented effectively, these measures could significantly reduce the accumulation of circular debt in the energy sector. Furthermore, if these reforms are enacted alongside increased solar panel uptake, the potential for reducing circular debt will be even greater.

The Indian state of Karnataka provides a valuable model that Pakistan can follow. Despite facing reduced production from thermal plants due to coal shortages, Bengaluru, the capital of Karnataka, was able to generate an average of 3,500 MW from solar power daily, thanks to its 7,349 MW installed capacity, including the Pavagada Solar Park. As a result, Bengaluru was able to meet more than 50% of its electricity demand.

In 2024, Karnataka’s Energy Ministry highlighted that the state successfully met peak summer demands through efficient grid management, renewable energy integration, and demand-side management. To further address fluctuating energy needs, Karnataka also engaged in power exchanges with states like Uttar Pradesh during periods of surplus energy. From October 2023 to May 2024, Karnataka supplied Uttar Pradesh with 300 MW to 600 MW of surplus power during specific hours, with Uttar Pradesh returning this power from June 16 to September 30.

Pakistan can adopt such strategies that integrate the expansion of solar energy with significant enhancements to its electrical grid. For instance, implementing smart metering has proven effective in reducing electricity theft and improving revenue recovery, as seen in Mozambique, where theft decreased from 43% in 1995 to 21% in 2011. Similar improvements have been observed in Cape Town, South Africa, where non-payment issues were mitigated, and in the Delhi Gate area of Walled City, Lahore, where T&D losses dropped from 17% to 7%.

Additionally, implementing demand management initiatives is crucial; these could save approximately 10-15% of primary energy and reduce electricity demand by 26.38%. Effective measures in this regard may include replacing conventional lamps and compact fluorescent lamps (CFLs) with LED lighting, starting with government buildings and streetlights. Furthermore, enhancing the power factor through capacitor installations, particularly in the industrial and agricultural sectors, will significantly contribute to addressing the country’s energy challenges. If implemented effectively, Pakistan has the potential to save 20% of energy in the agricultural sector, 24% in the commercial sector, 25% in the industrial sector, and 30% in buildings through demand management initiatives.

Rimsha Arif is a Teaching Fellow at the Department of Economics (LUMS).

Mahbub ul Haq Research Centre at LUMS

Postal Address

LUMS

Sector U, DHA

Lahore Cantt, 54792, Pakistan

Office Hours

Mon. to Fri., 8:30 a.m. to 5:00 p.m.