COVID-19 and the Future of Microfinance: Evidence and Insights from Pakistan

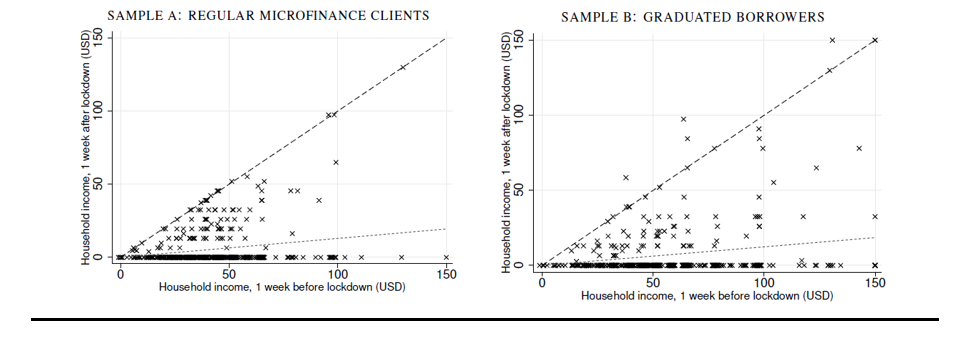

The COVID-19 pandemic threatens lives and livelihoods, and, with that, has created challenges for institutions that serve affected communities. We focus on implications for local microfinance institutions in Pakistan, a country with a mature microfinance sector, serving a large number of households. We conduct ‘rapid response’ phone surveys of about 1,000 microenterprise owners, a survey of about 200 microfinance loan officers, and interviews with 20 senior representatives of microfinance institutions and regulators in the sector. These surveys were conducted starting about a week after the country went into lockdown to prevent the spread of the novel coronavirus. We find that, on average, week-on-week sales and household income both fell by about 90% (Figure 1).

Note:This figure compares microenterprise household income before and after the lockdown: for the sample of regular microfinance clients, and for the sample of graduated borrowers who have progressed from a small borrower status to financial sustainability. Each figure shows a 45-degree line and an OLS regression line (imposing a zero intercept). Points on the 45 degree line denote no change in income 1 week before and after the lockdown; alternatively, a point below the 45 degree line implies that the income after the lockdown is lower than the income 1 week after the lockdown. The dotted line represents an OLS regression estimating the actual relationship between income 1 week before and after the lockdown For clarity, we top-censor the data at US$150, and apply a minimal random jitter in the x-axis.

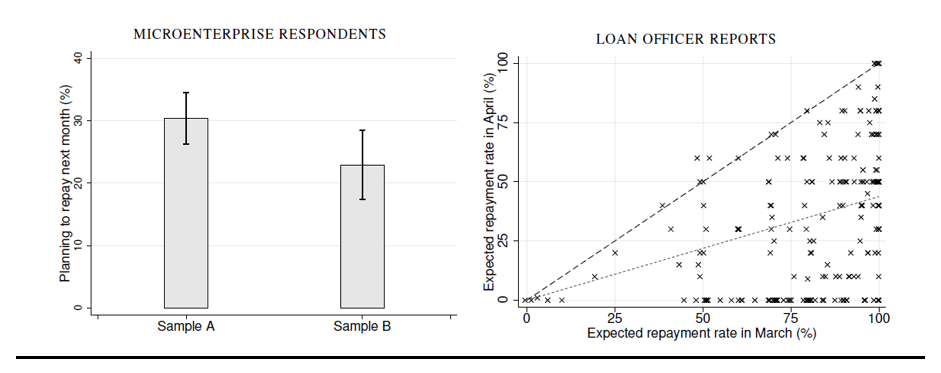

Households’ primary immediate concern in early April became how to secure food. As a result, 70% of the sample of current microfinance borrowers reported that they could not repay their loans; loan officers anticipated a repayment rate of just 34% in April 2020 (Figure 2).

Note: This figure shows the proportion of microenterprise respondents who anticipate making repayments for the next month (with 95% confidence intervals), for the sample of regular microfinance clients (‘Sample A’), and for the sample of graduated borrowers (‘Sample B’) who have progressed from a small borrower status to financial sustainability . We also show loan officers’ expected repayment rates, for March and April 2020. This scatterplot shows a 45-degree line and an OLS regression line (imposing a zero intercept). Points on the 45 degree line denote no change in expected repayment rates between March and April; alternatively, a point below the 45 degree line implies that the expected repayment rate in April is lower than the expected repayment rate in March. The dotted line represents an OLS regression estimating the actual relationship between expected repayment rates in April and in March 2020 for clarity, we apply a minimal random jitter in the x-axis.

Similar news has come from around the world1, highlighting the vulnerability of a sector that is dependent on a ‘high-touch’ model requiring frequent personal contact between lenders and clients, who primarily use microcredit to manage liquidity and match their volatile cashflows to their money management needs (Rutherford, 2000). Several recent studies have shown that a majority of microfinance clients use funds for inventory or other working capital rather than on capital investments that do not materially increase revenues or profits (Banerjee et al., 2019; Karlan et al., 2016; Meager, 2019; Said et al. 2020).Recognizing that microfinance is primarily about managing liquidity has implications, especially for regulation and oversight.

Soon after the pandemic hit, several governments, including those of Pakistan, India and Bangladesh, encouraged moratoria on loan repayments, allowing repayments to be deferred by up to a year. By April 2020, nearly 74% of the MFIs in South and East Asia responding to a CGAP Pulse Survey had reported morataria, restructuring almost half of their total portfolios (CGAP, October 2020). While the moratoria may have helped providers shore up liquidity at a time that it was direly needed, their long term effects on clients are less clear cut - interests will continue to accrue during the moratorium (CGAP, September 2020), effectively increasing the total amount repaid over the life of the loan.

With lockdowns easing up and businesses restarting, incomes have not gone back to the pre-lockdown levels (Agrawal and Ashraf 2020). In this context, revival will require financial support at a time when lenders remain cautious about providing new loans. Many MFIs around the world are facing an increasing demand for lower-quality credit and are reporting elevated portfolio-at-risk (PAR) - an indication of the stress faced by microfinance providers (CGAP, October 2020).

We build from the results of our survey and these recent developments to argue that the COVID-19 crisis requires a fundamental rethink of regulations and the direction of innovations in the sector. We frame the reconsideration around four points, designed to stimulate discussion in the microfinance policy community.

First, the premise that non-deposit-taking institutions should be exempted from prudential regulation because customers would not be hurt by failure or insolvency (and perhaps could even be helped) is highly questionable if the primary use of the product by customers is managing liquidity. If sources of liquidity dry up, consequences can be much more severe in a much shorter time frame, and with devastating effects for both sides of a market. Specifically, the surveys point to significant near-term, and absent action to provide future access to financial services, with the potential of adverse long-term effects for most microfinance customers. The Government must consider emergency liquidity facilities and recapitalization to allow MFIs to forbear or forgive current loans and be in a position to extend liquidity management products when the pandemic is under control.

Second, now is the time to extend regulation and supervision beyond financial oversight to consumer protection2. The MFI CEOs we surveyed shared concerns about the behaviour of field staff pressurizing clients to forgo the moratorium and pay on time, or alternatively, aggressively lending to vulnerable borrowers to meet their lending targets; loan officers and customer reports showed they were right to be concerned. When a product plays such a large role in poor households’ financial lives, it inordinately shifts the balance of power towards the provider of the product and behooves governments to ensure that those households are protected from exploitation by the providers. Governments should work with MFIs to develop consumer protection guidelines and introduce regulation to operationalize them.

Third, the pandemic underlines the importance of innovating and introducing digital services that enable transactions with minimal physical contact between loan officers and clients. However, the current crisis also illustrates just how far there is to go before digital financial services change operating procedures in the industry. Deploying technological solutions is capital intensive – both in terms of financial and of human capital. In our survey, MFI CEOs were wary of digital communications with customers and we suspect their concerns would be widely shared around the world. On top of illiteracy, there is ample room for misinterpretation of messaging. In addition, MFIs’ financial and human capital is likely to be very constrained and will need to be devoted to lending operations to restore positive cash flow before MFIs can begin to invest in a digital transition.

Finally, two of the most important, but intangible assets built up by microfinance - trust and social capital - are at risk. MFIs, with exceptions have built up a great deal of trust with their customers by following rules-based processes and providing reliable services in environments where both are often lacking (Collins et al., 2009; Roodman, 2012). Without coordinated action between MFIs, regulators and supervisors, and investors trust in MFIs could be destroyed by the present crisis. Deposit-taking institutions are obviously of key concern. But as many MFIs struggle to secure a future, their behaviour in terms of treatment of customers, especially their ability to monitor the behaviour of loan officers and field staff, will play a large role in whether the trust that has been built up remains intact.

The COVID-19 pandemic is different from crises that have come before. MFIs are suffering from both a lack of repayments and a lack of access to capital and liquidity from funders. What our surveys have documented in Pakistan seems to be playing out in most countries—and thus we are seeing a crisis for the industry as a whole. If the current pandemic continues for long, whatever emerges will likely be substantially different from what we have seen over the last 40 years. MFI’s and MFB’s reported that active loans have gone down due to pandemic. However, the reduction in loan portfolio was lower than initially expected. The SBP loan scheme for paying wage bills has helped a number of MFI’s managing financial difficulties during the crisis. MFI’s and MFB’s have survived the first wave of complete lock down in terms of massive defaults. However, if there is another complete lock down it may pose serious threats of bankruptcies for microfinance institutions and banks in Pakistan.

1 See, for instance, https://devpolicy.org/microfinance-and-the-informal-economy-under-covid-19-20200624-2/ and https://www.cgap.org/research/covid-19-briefing/consumer-protection-and-covid-19-borrower-risks-economies-reopen

2 The Securities and Exchange Commission of Pakistan regulates microfinance institutions with an eye to consumer protection and ensuring that customers have a form of redress. The challenge is to extend such regulation to more countries and to ensure that regulations are adequately enforced.

Kashif Z. Malik is an Associate Professor at the Lahore University of Management Sciences

Farah Said is an Assistant Professor at the Lahore School of Economics and a Research Fellow at the Centre for Research in Economics and Business (CREB).

Mahbub ul Haq Research Centre at LUMS

Postal Address

LUMS

Sector U, DHA

Lahore Cantt, 54792, Pakistan

Office Hours

Mon. to Fri., 8:30 a.m. to 5:00 p.m.