De-Dollarization in Pakistan: A Promising Path or Distant Dream? | The Friday Economist

The Friday Economist is a collaborative blog series between LUMS MHRC and the CNM Department of Economics at LUMS

De-dollarization is a deliberate move by nations to reduce their dependence on the United States dollar (USD) in international trade, transactions, and reserves. This shift is driven by geopolitical tensions: the Ukraine-Russia conflict and Western sanctions, which have led to changes in cross-border trade and payment systems. Additionally, aggressive rate hikes by the U.S. Federal Reserve aimed at controlling domestic inflation have also prompted a shift in global trade. The higher Fed rate makes borrowing, capital inflows, and imports more expensive for many developing countries, including Pakistan. This happens because more money flows to the US, where it can earn higher returns. This boosts the US dollar’s value, which harms the trade and payments balance of the economies trading in the USD.

As the U.S. employs USD in its sanctions against Russia and Iran, many nations are showing a growing inclination to explore substitute currencies for their trade, investment, and reserves. They are also looking into the development of alternative multilateral clearing systems independent of Society for Worldwide Interbank Financial Telecommunication (SWIFT). Furthermore, both Russia and China have introduced their cross-border payment mechanisms as options to the U.S.-dominated SWIFT network.

Within this context, Pakistan is also deliberating, in policy circles, the potential advantages and challenges of de-dollarization. This blog post addresses two critical questions: First, what implication does the dominance of the dollar have for Pakistan’s economy? Second, is de-dollarization a feasible strategy for Pakistan?

Dollar Dominance in Pakistan

Pakistan strategically holds USD in its foreign exchange reserves, used for managing the country’s Balance of Payments, and facilitating international import payments. While official government financial transactions are primarily conducted in PKR, the USD plays a pivotal role within specific sectors of the economy. This practice is influenced by two key factors: Firstly, the majority of global energy transactions are conducted in USD. Secondly, the USD is the preferred medium for cross-border trade settlements.

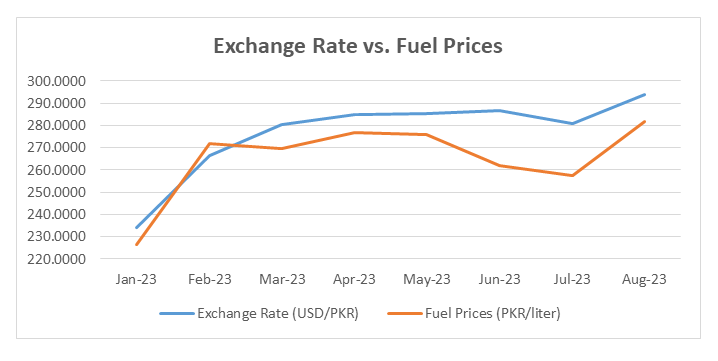

The economy's reliance on USD has exposed it to significant repercussions from the recent dollar hike. By early September 2023, the dollar surpassed PKR 300, reaching PKR 308.1 on September 5, 2023. Figure 1 shows the direct correlation between the rising dollar rate and the increased fuel prices.

Figure 1: Exchange Rate vs. Fuel Prices, January – August 2023

Source: Pakistan Bureau of Statistics

As of December 2022, Pakistan's total external debt and liabilities reached USD 126.3 billion. Of this, approximately 77%, equating to USD 97.5 billion, constitutes direct obligations of the Pakistani government to diverse creditors. This encompasses multilateral debt from institutions such as the World Bank, Asian Development Bank, IMF, in addition to Paris Club debt, private and commercial loans, and Chinese debt. Additionally, government-controlled public sector enterprises carry an additional USD 7.9 billion in debt, primarily to multilateral creditors. As a result, around 83.55% of Pakistan's external debt is dollar-denominated. In addition, 86% of Pakistan's trade is denominated in USD, as has historically been the case, with euro-denominated exports and imports accounting for less than 10%.

Implications of Dollar Dominance

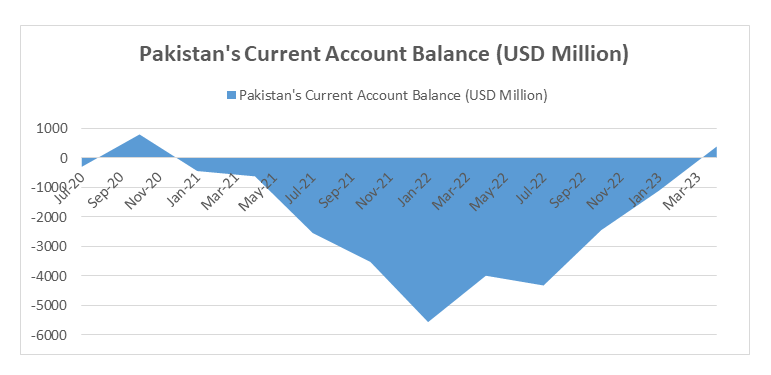

Pakistan’s reliance on USD has left it vulnerable to significant currency depreciation, near-hyperinflation, diminished import capacity, a growing current account deficit, and declining foreign reserves. Recent data reveals a concerning 3.1% year-on-year growth in Pakistan's trade deficit. This is mainly due to a substantial 7.3% surge in imports, despite a 12.9% rise in exports. Figure 2 vividly illustrates Pakistan’s consistent trade deficit since January 2021.

Figure 2: Pakistan’s Current Account Balance (USD Million), Jul 20 – Mar 23

Source: China Economic Information Center Data

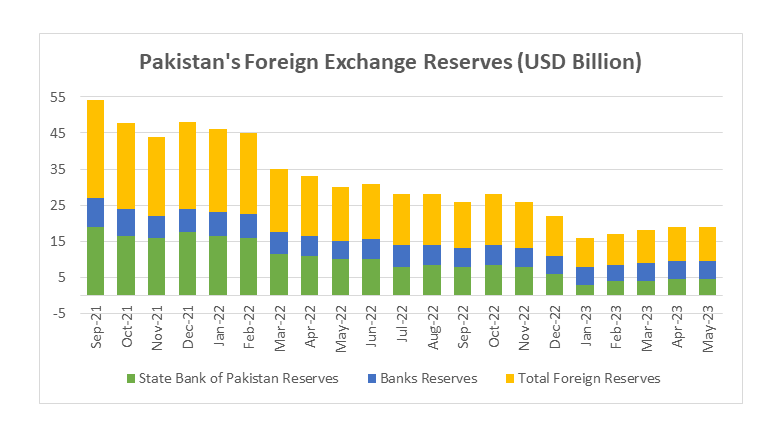

To combat currency depreciation, Pakistan implemented measures that included selling foreign exchange reserves to mitigate the decline and restore stability. In a period of six months, the foreign exchange reserves of the State Bank plummeted to $10.3 billion in June 2022, a drop of 38% from January 2022 (see Figure 3). This rapid depletion can be directly attributed to the escalating prices of imported goods, posing a looming threat of bankruptcy if this trend persists.

Figure 3: Pakistan’s Foreign Exchange Reserves (USD Billion), Sept 21 – Mar 23

Source: State Bank of Pakistan

Is De-dollarization viable for Pakistan?

For Pakistan, a potential de-dollarization strategy revolves around forging closer relationships with neighboring nations and incorporating regional currencies into its trade mechanisms. Using currencies like the Chinese Yuan or Dirham for trade can diminish the economy’s reliance on the USD. An illustrative instance is Pakistan's recent transition to buying Russian oil in Chinese Yuan in June 2023, a departure from its prior practice of conducting oil transactions in USD. This shift offers several potential advantages, including access to discounted oil and enhanced access to Chinese financial institutions. It also facilitates Pakistan's capacity to engage in commercial borrowing from these banks, allowing it to redirect a segment of its expenditure for oil imports to Yuan and mitigating its existing dollar shortage.

Although Pakistan has the potential to capitalize on these evolving global dynamics, primarily due to its strategic alignment with China, it must avoid alienation from the U.S., a vital economic ally. The US Dollar has a large global footprint, with around 60% of global trade invoicing in USD. Instead, this situation could be characterized as an opportunistic rivalry among global powers competing to strengthen their economic and political influence. Pakistan must tread carefully to avoid being caught in the crossfire.

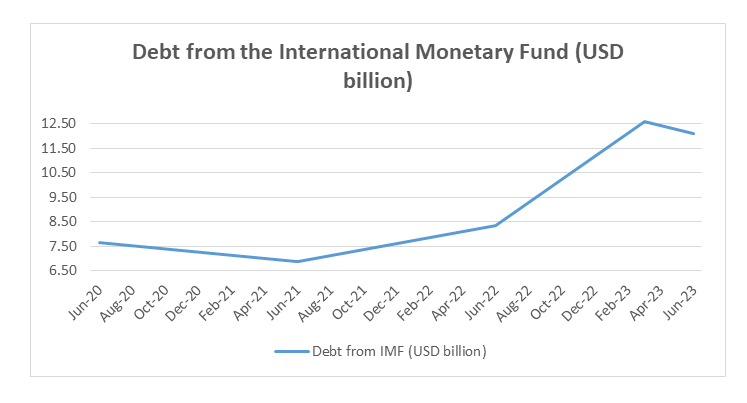

The pressing issue lies in the current account deficit, which is financed by various bilateral and multilateral loans, with the IMF being a significant contributor. This strategy has resulted in Pakistan holding a significant portion of its debt in foreign currency in USD. From July to September 2022 alone, Pakistan secured projects and program loans/grants from a variety of foreign sources. Over 50% of these funds originated from the IMF, approximately 30% provided by multilateral partners such as the World Bank and Asian Development Bank and 17% coming from bilateral partners. Over the past three years, Pakistan's debt from the IMF alone has exceeded USD 6 billion, as indicated in Figure 4. Shifting away from the USD could disrupt Pakistan's debt management, potentially jeopardizing a substantial portion of vital foreign assistance used during economic crises.

Figure 4: External Debt received from IMF (USD billion), Jun 20 – Jun 23

Source: State Bank of Pakistan

De-dollarization may pose limitations on Pakistan's ability to meet its existing debt obligations. It may be viable only if debt is forgiven, which is an infrequent occurrence, or if creditors generously opt for debt restructuring or offer relief by allowing for repayment in local currency.

Lastly, de-dollarization debate transcends a mere currency swap shifting Pakistan dependency from the USD to another currency. Instead, it calls for a comprehensive economic policy reform. This shift should serve as a catalyst for promoting self-reliance rather than relying on foreign aid in turbulent times. By fostering self-sufficiency, Pakistan can diversify its currency holdings and reduce its dependence on foreign aid, thereby bolstering economic autonomy and stability.

The Way Ahead

Crucially, then, it seems that de-dollarization's viability is intertwined with Pakistan's need to reduce its dependence on institutions such as the IMF. Unlike India and Bangladesh, Pakistan has displayed a growing reliance on the IMF to finance its trade deficit.

Despite its reliance on the USD and vulnerability to economic shocks caused by dollar fluctuations, Pakistan’s current economic conditions dictate that it will have to continue to seek support from both the IMF and its Chinese partners, without favoring one over the other. In the absence of substantial debt relief from creditors and a deliberate push to industrialize its exports and enhance manufacturing value-added, de-dollarization remains a distant dream for Pakistan.

Eeman Shahzad Qureshi, Teaching Fellow, CNM Economics Department, LUMS

Rimsha Arif, Teaching Fellow, CNM Economics Department, LUMS

Mahbub ul Haq Research Centre at LUMS

Postal Address

LUMS

Sector U, DHA

Lahore Cantt, 54792, Pakistan

Office Hours

Mon. to Fri., 8:30 a.m. to 5:00 p.m.