From Margins to Mainstream: Microfinance for Transgender Empowerment in Pakistan | The Friday Economist

In Pakistan, the transgender community, known as "Khawaja Siras," grapples with deep-rooted prejudice, violence, and marginalization, placing them among the most vulnerable groups in society. Defined by their existence outside traditional gender binaries, these individuals represent a unique third gender identity.

From a young age, many transgender individuals endure family estrangement and face discrimination from landlords who refuse them housing based on their identity. Consequently, they often find themselves without a home, forced to seek refuge in urban slums or precarious, unsafe buildings. Resorting to street begging becomes a means of survival to cover rent, perpetuating their cycle of exclusion from education, employment, and essential services like healthcare.

Despite these daunting challenges, governmental support for this marginalized group remains inadequate. Amidst these adversities, microfinance offers a glimmer of hope. Microfinance initiatives have the potential to empower transgender individuals, fostering economic independence and social inclusion.

In this blog post, we delve into the potentially transformative role of microfinance in the current socio-economic plight of transgender individuals in Pakistan.

Socio-Economic Status of Transgender

Transgender individuals in Pakistan face significant under-representation and systemic exclusion from society. Historically, an absence of official data collection about a third gender made it difficult to quantify their population across the country. Estimates from various studies varied widely, ranging from 0.4 million to 1.5 million.

A landmark ruling by the Lahore High Court in 2017 marked a significant step ahead in recognizing the transgender community's existence by including them in the Government of Pakistan census. The 2017 census revealed a startlingly low count of only 10,418 transgender individuals in the country, highlighting the extent of under-reporting. On the other hand, the Sixth Population and Housing Census data collected by the Pakistan Bureau of Statistics reveal a total of 21,744 transgender individuals in the country, with 55.12%, totaling 12,002 people, residing in urban areas, while 44.88%, totaling 9,772 people, living in rural regions.

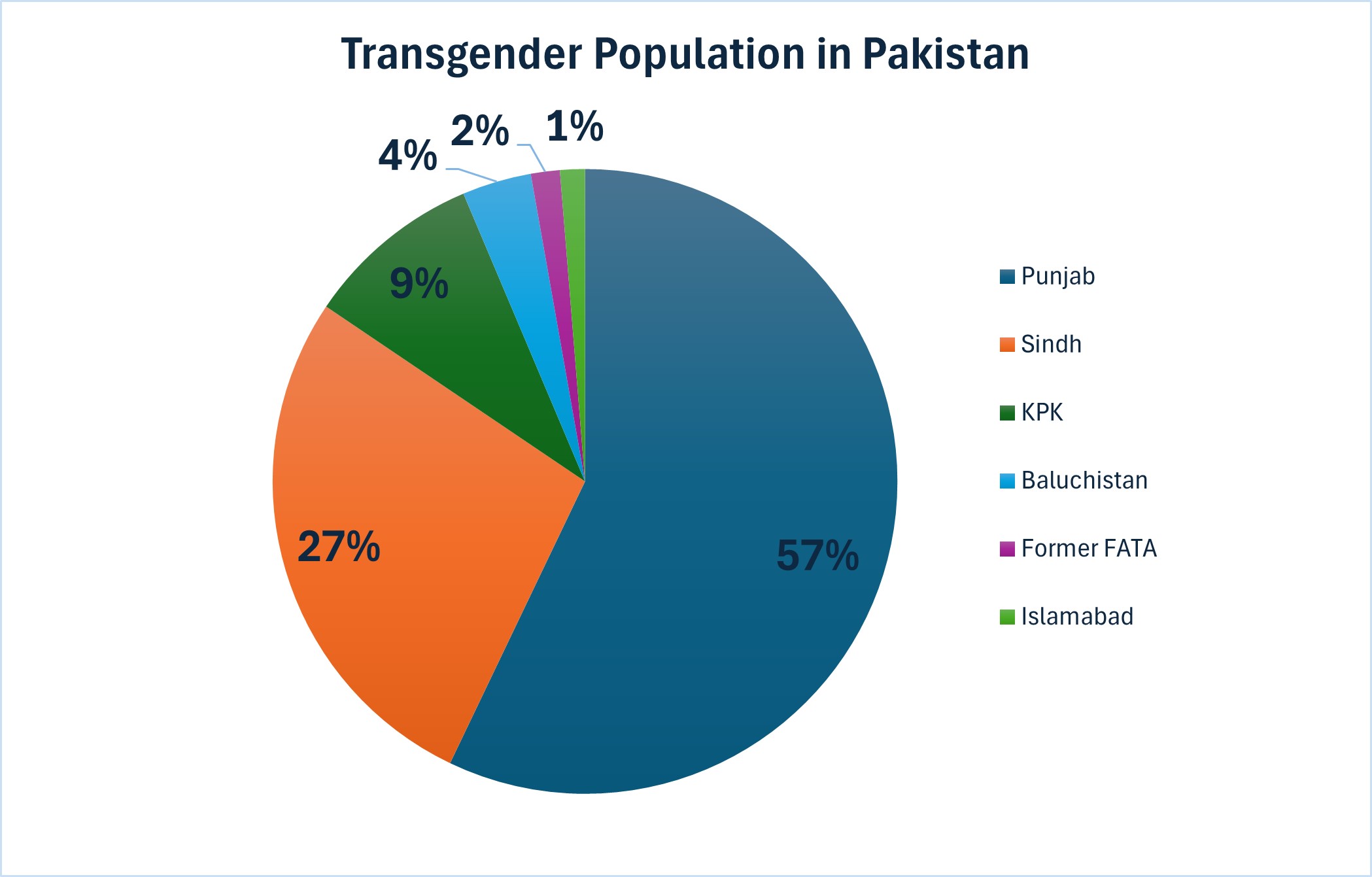

Punjab emerged as the province with the highest transgender population, accounting for 57.11% of the country's total, with 12,435 individuals registered. Sindh followed with 5,954 individuals, constituting 27.34% of the total. Khyber Pakhtunkhwa recorded 1,999 transgender individuals, representing 9.18% of the country’s total, while Baluchistan had 780. Additionally, KP’s merged districts reported a transgender population of 326, and Islamabad with 280. Figure 1 represents this distribution of the transgender population across Pakistan, as reported in 2017.

Figure 1: Transgender Population in Pakistan, 2017

Source: Pakistan Bureau of Statistics

Until 2009, transgender individuals were denied Computerized National Identity Cards (CNICs) by the government. However, following a Supreme Court ruling in December 2009, the National Database and Registration Authority (NADRA) began facilitating CNIC issuance to the transgender community. Despite this progress, obtaining CNICs remains a challenge, with bureaucratic hurdles and societal discrimination often leading to social and financial exclusion.

A state ID is critical to every Pakistani citizen’s well-being because it is essential for accessing a wide range of services and opportunities. Without a CNIC, transgender individuals are unable to open bank accounts, obtain formal employment, access healthcare, or exercise their right to vote. It also hinders access to social welfare programs and educational opportunities, leading to broader social and financial exclusion.

In addition to being denied their constitutional and democratic rights, and facing barriers to obtaining official identification documents, at least 90% of transgender individuals face workplace discrimination that contributes to their unemployment, financial struggles, and homelessness. Limited access to sustainable income sources and restricted educational opportunities further compounds their economic disadvantage, making it difficult for them to secure dignified employment. A USAID and Aurat Foundation study reveals that for approximately 70% of transgender individuals, the main source of income is dancing, sex-work or begging.

The Role of Microfinance in Empowering Transgender

Microfinance provides transgender individuals with access to financial services such as small loans, savings accounts, and insurance. By empowering them to start their own businesses or engage in income-generating activities, microfinance enables economic independence and reduces reliance on informal and often exploitative sources of income, such as begging and sex-work. Whether it's starting a tailoring business, opening a beauty salon, or investing in agricultural activities, microfinance offers transgender individuals the opportunity to pursue sustainable livelihoods and break free from poverty.

A prominent microfinance organization dedicated to the social and economic inclusion of transgender individuals is the Akhuwat Foundation. Established in 2001, it has assisted over 1,500 transgender individuals across various cities, including Lahore, Faisalabad, and Karachi. For instance, 34-year-old Khawaja Siran expressed the need for a loan of PKR 25,000 to purchase an embroidery machine. She highlighted that obtaining a loan from a microfinance institution like Akhuwat Foundation proved to be more accessible than traditional banks, largely due to prevalent cultural and societal barriers.

In addition to financial support, microfinance institutions often offer training and capacity-building programs tailored to the specific needs of transgender clients. These programs equip them with essential skills in entrepreneurship, financial management, and business development, enhancing their ability to succeed in the marketplace. A similar experience was shared by a 44-year-old Khawaja Siran who emphasized how a microfinance institution supported her in enhancing her skills through a textile design course. Subsequently, she was able to secure an interest-free microfinance loan of PKR 150,000, enabling her to kickstart her own clothing business. By fostering a supportive learning environment, initiatives like the Akhuwat Foundation empower transgender individuals to challenge stereotypes, build confidence, and assert their rights as productive members of society.

Additionally, the Khwajasira Support Program by Akhuwat Foundation provide monthly income support of PKR 1200 to transgender individuals aged 40 and above, with monthly incomes of less than PKR 10,000. It issues a unique Akhuwat ID card, facilitating economic rehabilitation and serving as a platform for sensitization campaigns to promote social acceptance. In addition to financial support, the program offers interest-free loans, capacity building trainings and workshops, career counseling and employment opportunities, financial literacy as well as health services to the transgender individuals.

Microfinance initiatives also play a crucial role in promoting social inclusion, breaking stereotypes and raising awareness about the rights and needs of transgender communities. By engaging with transgender clients and local communities, microfinance institutions facilitate dialogue, dispel misconceptions, and combat stigma and discrimination. Moreover, by mainstreaming transgender inclusion in their operations and outreach efforts, microfinance institutions send a powerful message of acceptance and solidarity, paving the way for greater social acceptance and respect.

In this way, microfinance serves as a catalyst for broader social change by advocating policy reforms and legal protections for Pakistan’s transgender community. Through strategic partnerships with civil society organizations, human rights activists, and government agencies, microfinance institutions can significantly amplify the voices of transgender communities and mobilize support for policy initiatives aimed at promoting their rights and well-being. The Khwajasira Support Program has already established partnerships with Unilever Pakistan, the Punjab Skills Development Fund, the Punjab AIDS Control Program, Mayo Hospital, and has research collaborations with King Edward Medical University and Kinnaird College. Through these efforts, the program aims to achieve both economic independence and social acceptance for the transgender community.

Why is Microfinance Uptake Among Transgender Low in Pakistan?

Despite the clear advantages of microfinance, its uptake remains low within Pakistan's transgender community. This can be attributed to various obstacles hindering access to financial products and services from formal institutions. On the demand side, challenges include low levels of financial literacy, inadequate documentation for opening bank accounts, limited interest from individuals, and a lack of formal employment opportunities.

Meanwhile, on the supply side, issues such as unfriendly attitudes from bank staff, insufficient provision of legal documentation by the government, limited information dissemination, and a scarcity of tailored financial literacy programs specifically for the transgender community further contribute to the low adoption of microfinance.

In 2021, the Ehsaas Kafaalat Programme took an encouraging step towards including transgender individuals by providing monthly stipends of PKR 2000 and facilitating bank account openings for those with a CNIC. The Benazir Kafalat Programme, part of the Ehsaas umbrella, declared the eligibility of transgender individuals for cash transfers in 2023, offering quarterly financial assistance of PKR 7000 to those with CNICs specifying their gender as transgender. However, the impact of both programs remains minimal and challenging to document accurately, as approximately 90% of transgender people do not possess identity cards due to family disownment and the deliberate omission of their names from official records to avoid societal stigma and disgrace.

How to Combat this?

To overcome the socio-economic and cultural challenges facing transgender rights in Pakistan, a multifaceted approach is necessary. Strengthening anti-discrimination laws is crucial, extending protections to transgender individuals in employment, education, and public services. Additionally, streamlining the CNIC application process through dedicated help desks and mobile units can ensure widespread access to documentation services, promoting inclusion and recognition of transgender identities nationwide.

Implementing group lending models can be particularly effective. In Bangladesh, the Grameen Bank has successfully used group lending to empower marginalized groups.

This model can be particularly helpful for transgender individuals in Pakistan, by leveraging the principles of collective responsibility and peer support. This model enhances creditworthiness by allowing members to pool their credibility, thus reducing the need for individual collateral or credit history. Transgender individuals, who often face difficulties in accessing traditional financial services due to lack of collateral or previous credit history, can greatly benefit from this collective approach. By sharing the risk among group members, the barriers to accessing loans are significantly lowered.

In India, digital financial services have been crucial in reaching marginalized communities. By leveraging mobile banking and digital payment systems, microfinance institutions in Pakistan can provide easier access to financial services for transgender individuals, especially those in remote areas who may face mobility issues or discrimination at traditional banking institutions.

Lastly, microfinance institutions in Pakistan should incorporate comprehensive financial literacy training as part of their services to help transgender individuals better manage their finances, understand loan terms, and develop sustainable economic practices.

Eeman Shahzad Qureshi is a Teaching Fellow at the LUMS CNM Department of Economics

Rimsha Arif is a Teaching Fellow at the LUMS CNM Department of Economics

Mahbub ul Haq Research Centre at LUMS

Postal Address

LUMS

Sector U, DHA

Lahore Cantt, 54792, Pakistan

Office Hours

Mon. to Fri., 8:30 a.m. to 5:00 p.m.