Tax Reforms in Pakistan – Missing the Mark, Again.

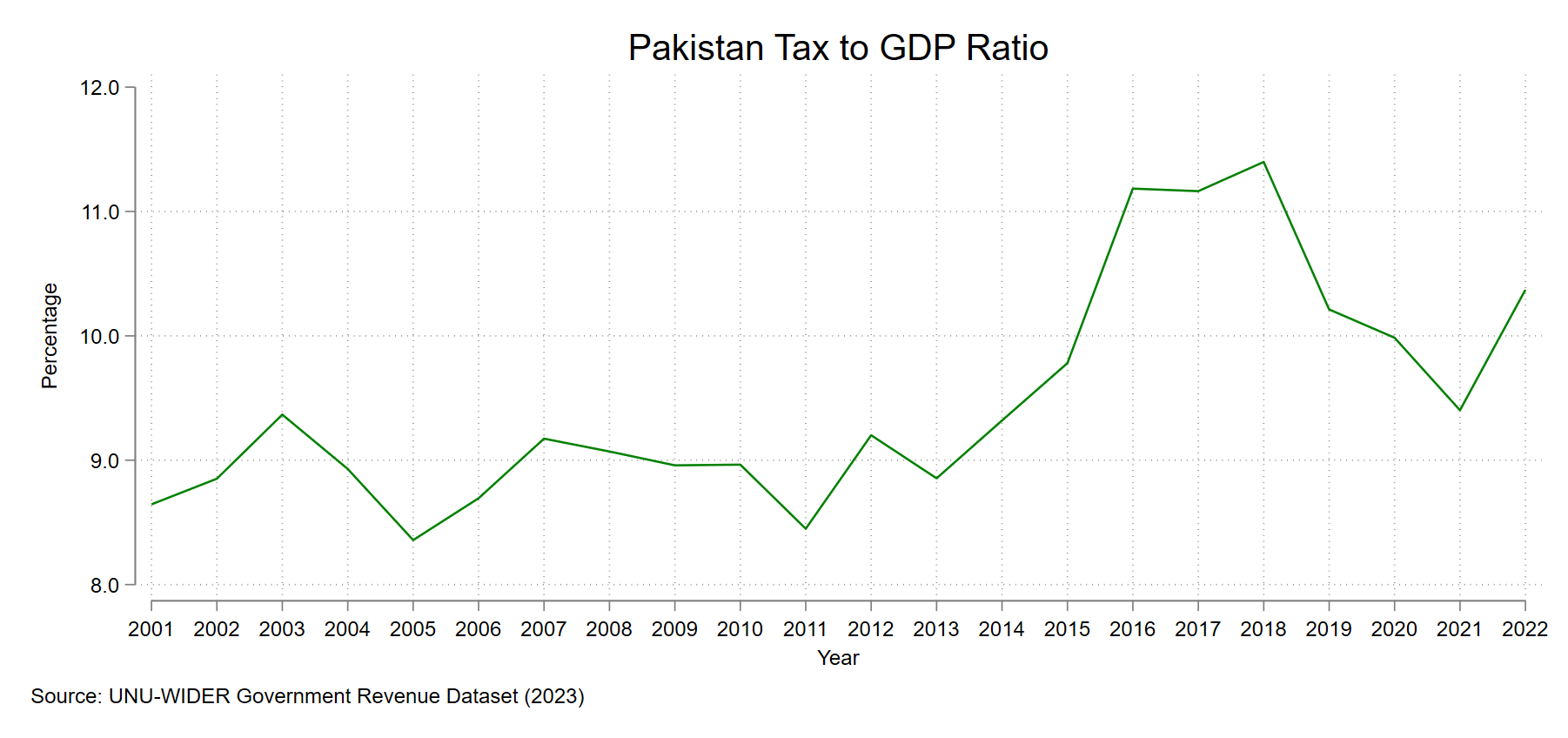

There is considerable commentary on the problems with Pakistan’s taxation system. Despite efforts to reduce inefficiencies, our tax-to-GDP ratio remains below the Asia Pacific regional average which was 19.3% in 2022 (OECD Tax Report). In the same year, Pakistan’s tax-to-GDP ratio stood at only about 10.3% (Figure 1).

Figure 1: Pakistan Tax-to-GDP Ratio

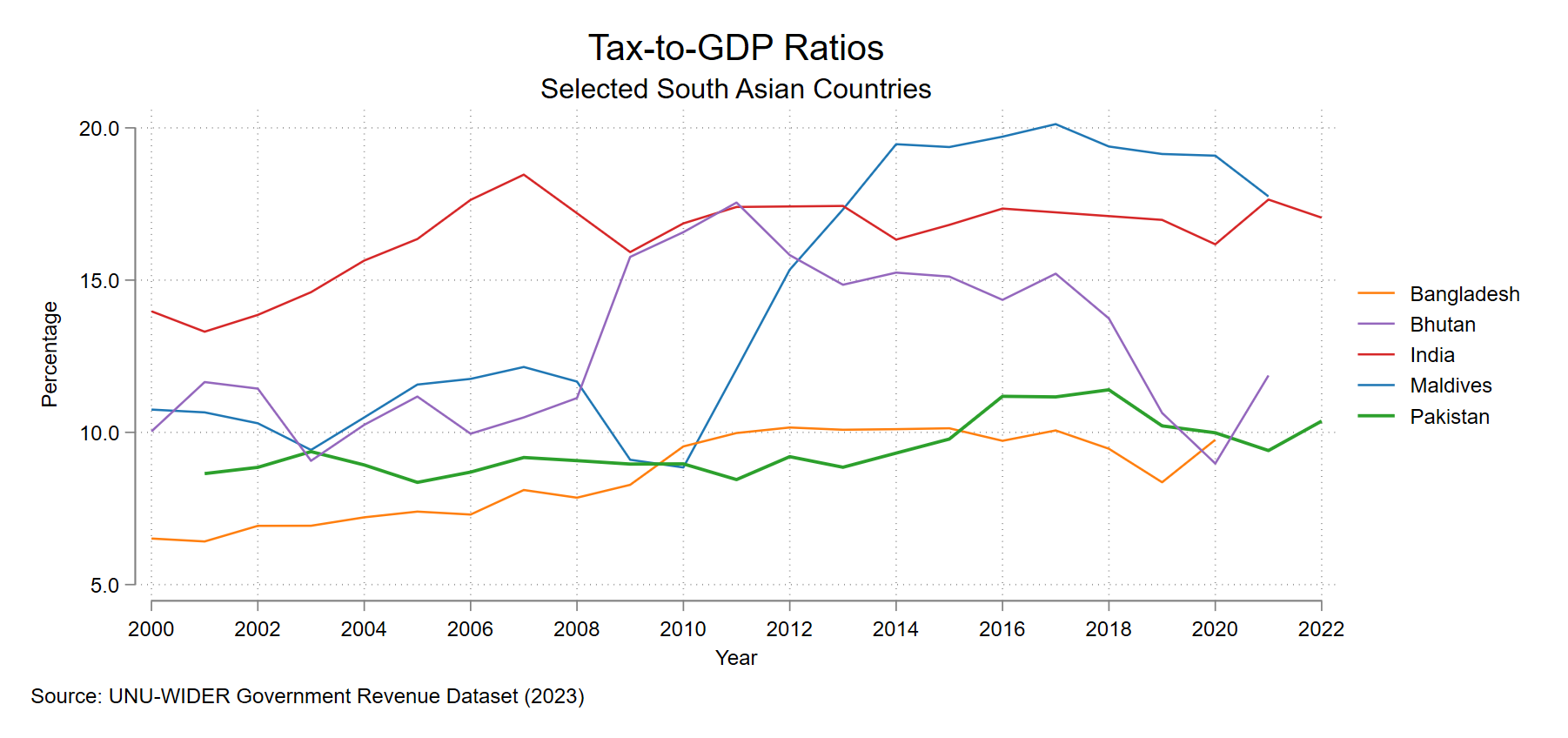

In fact, Pakistan’s tax-to-GDP ratio has been worse than some other South Asian countries such as Maldives and India (Figure 2).

Figure 2: Tax-to-GDP Ratios in South Asia

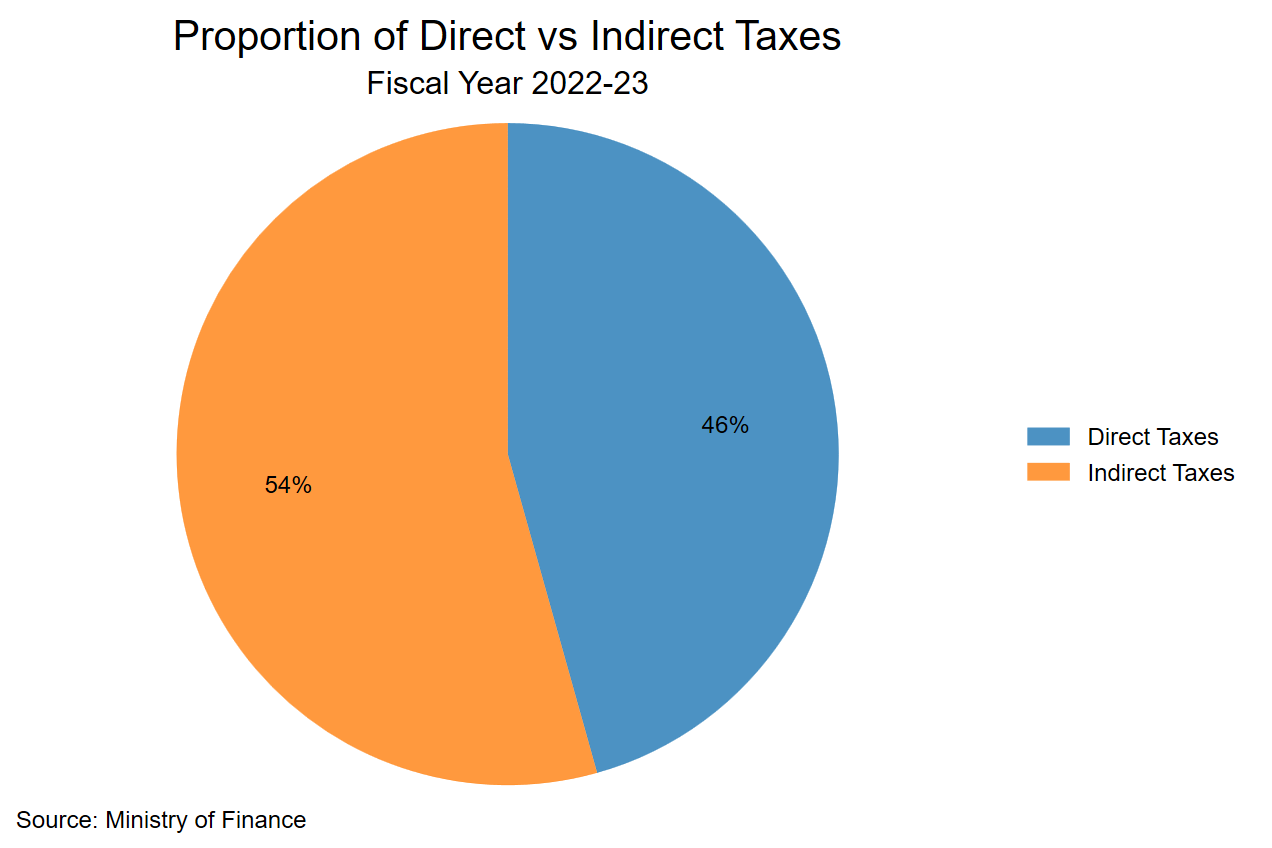

Moreover, efforts to increase tax revenue result in significant reliance on indirect taxes (Figure 3) which are regressive in nature.

Figure 3: Pakistan – Direct vs Indirect Taxes

Furthermore, some sectors are overtaxed while others benefit from a more liberal tax structure. These differences in tax burden disincentivize work and foster perceptions of unfairness among those bearing a higher tax burden.

We compare the GDP shares of some sectors with their contributions to tax revenue. Ideally, each sector’s share in tax revenue should align with its share in GDP but this is not the case in Pakistan. During the fiscal year 2022-23, the agriculture sector accounted for 23% of Pakistan’s GDP, industry 18.4%, and services 58.4% (State Bank of Pakistan – GDP Stats). However, their respective shares in tax revenue were:

Agriculture: 0.6%

Industry: 70%

Services: 29.4%

(Source: Tribune)

The State Bank of Pakistan reports similar numbers for 2017-18. Thus, agriculture and services sectors are undertaxed while industry is overtaxed. There are many reasons for this. The industrial sector has many taxes imposed on it, some of which fall under the federal domain while others are collected by provinces. This complex tax structure means that this sector must pay a multitude of taxes to different collectors which translates into a higher tax burden. Also, most of the industrial transactions are formally documented and therefore, easy to tax. As Pakistan has historically struggled with increasing tax revenues, often those sectors which are easier to tax, bear greater tax burden.

The services sector is undertaxed because a substantial portion its transactions operate informally and are cash-based, which leads to tax evasion. To understand this, consider example of doctors consulting in a hospital. If they do not accept payments through card or bank transfer, it is easier for them to underreport their income.

The agriculture sector remains undertaxed because of political resistance from influential landlords. Further, agricultural tax is collected by provincial governments, the federal government; and there are inefficiencies which result in poor tax administration and collection (International Centre for Tax and Development). Like the services sector, agriculture also operates informally which further complicates tax enforcement. This differential in tax burden across sectors distorts incentives and opens up avenues for evasion and unethical practices to pay smaller amounts of tax.

We also study how the existing tax regime impact salaried individuals who primarily belong to the middle-income class. Estimates suggest that salaried people in Pakistan are also overburdened under the existing tax regime. According to Ammar H Khan, a professor in the Institute of Business Administration, salaried people constitute only 2% of the labor force while they contribute 15% in total tax revenue (Article in Dawn). In the fiscal year 2023-24, the salaried class paid Rs 368 billion in taxes, which was 39% higher than the preceding year. This amount is 232% more than the combined taxes paid by exporters and retailers. After contractors, bank depositors and exporters, salaried class is the fourth largest contributor to withholding taxes. The main reason for this is that the salaried class is the most reliable source of direct tax revenues because their income tax is deducted at the source. It is easier to underreport income if an individual or an entity is earning through cash transfers, instead of bank transfers or pay orders.

In the following sections, we analyze the tax provisions in the 2024 Finance Act (FA) to evaluate how they address the issues related to tax collection.

Provisions in the budget for addressing these gaps:

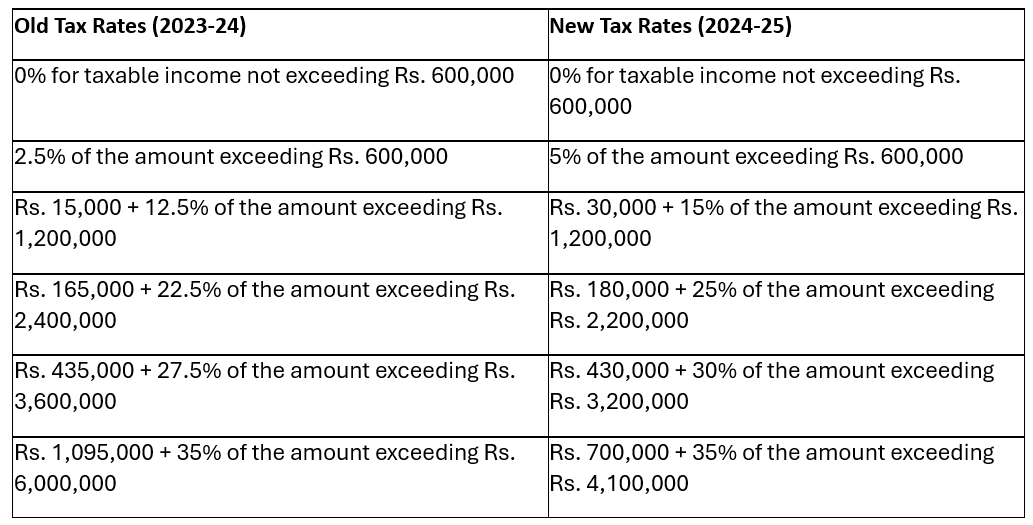

In the Budget Speech 2024-25, the Finance Minister of Pakistan Mr. Muhammad Aurangzeb announced some changes in the tax policies, as part of the Financial Bill 2024. The main reason for introducing these reforms was to increase the tax-to-GDP ratio by broadening the tax base. In order to expand the tax base, both direct and indirect tax rates have been increased. In particular, the government has significantly increased income tax rates for both salaried and business individuals. Tables 1 and 2 below show the tax rates for different yearly income brackets, for salaried and business individuals respectively.

Table 1: Tax Rates for Salaried Individuals (Source: Crowe 2024 The Finance Bill Tax Commentary)

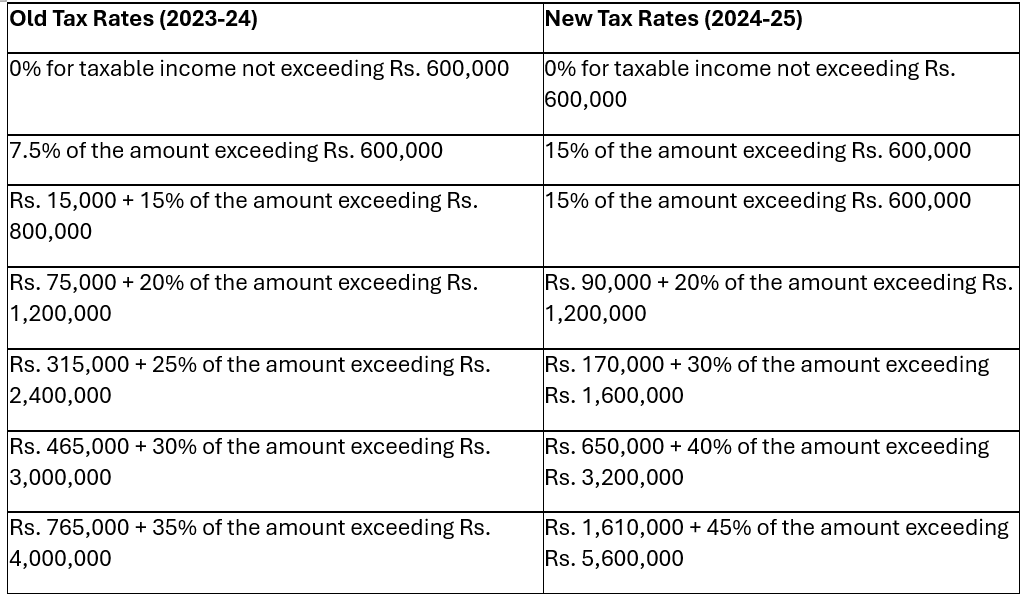

Table 2: Tax Rates for Business Individuals (Source: Crowe 2024 The Finance Bill Tax Commentary)

As evident from Table 1, both the fixed amount of tax and the tax rates have increased considerably for most of the income brackets above Rs 600,000 per annum, which will result in reduced disposable incomes for salaried individuals. According to the Finance Minister, these changes aim to preserve the progressive tax system, which provides relief to low-income individuals and charges higher taxes to high-income individuals. In addition, a surcharge of 10% has been imposed on salaried individuals, business individuals and Associate of Persons (AOP) with taxable incomes above Rs 10 million.

According to Table 2, the fixed tax amounts and tax rates on profits (above Rs. 600,000 per annum) have also been increased for corporations.

Some new measures have been announced to deal with long-standing issues of tax fraud and tax evasion issues. The FA has introduced provisions in Income Tax, Sales Tax and Federal Excise Laws to establish the Tax Fraud Investigation Wing (TFIW) in order to investigate and prevent tax fraud. Moreover, the individuals who do not appear on the Active Taxpayer List (ATL) i.e. non-filers, will face double tax rates and restrictions on foreign travel, blocked sims and utility disconnections. The implementing agencies can face fines of upto Rs 100 million for failing to enforce these penalties. Furthermore, the tax rates for late filers on the purchase or sale of property will be higher than those for on-time filers, but lower than those for non-filers, except for those who have filed their returns on time, for the last three fiscal years. The withholding tax for non-filers on the internet and telecom subscriptions has also been increased.

In addition, the Government plans to digitize the economy to include informal businesses into the tax net. The FBR has made it mandatory for the businesses such as private educational institutions, small and medium sized retailers, beauty parlors, fitness centers, transporters, clinics, laboratories and marriage halls to install Point-of-Sale (POS) systems by 1st July 2024 to increase transparency in sales reporting and minimize tax evasion.

How effective are these provisions?

Due to these updated tax reforms, the tax burden on the salaried class has further intensified. Given that inflation was already high i.e. 25.97% in July-April 2023-24 (Economic Survey of Pakistan), these measures have reduced the disposable income and the purchasing power of the salaried class, which will disincentivize them from working in the country. The number of individuals migrating out of Pakistan has already increased from less than 300,000 in 2021, to 832,000 in 2022 and 862,000 in 2023 (Pakistan Migration Report 2024). These measures can potentially contribute to this exodus, further decreasing the tax revenue and the tax-to-GDP ratio.

While these reforms aim to expand the tax net, they do not address the underlying issues behind Pakistan’s low tax collection. The FA does include provisions for digitization and audit of the tax collection process, to bring the undocumented sectors into the tax net. However, these appear to mostly be focused on the industrial sector (as they rely on electronic invoicing and POS systems). Similar initiatives are needed for services, which hold immense potential for tax revenue growth. Also, small and medium sized businesses in less developed areas do not have sufficient technological resources and digital literacy to install POS systems and integrate them with FBR. The government should provide assistance and incentives to ease this transition for such businesses. Additionally, many informal businesses are reluctant to enter the tax net due to the fear of increased scrutiny, which can lower the success of digitization efforts.

Moreover, while several disincentives have been introduced for non-filers, the tax filing process can be difficult to understand. Several individuals and businesses must rely on professional help to file their tax returns, which incurs an additional cost. Significant efforts need to be made in digitizing and simplifying the tax filing process.

One of the main reasons for the indulgence in tax evasion, is the lack of trust in the government. The government can address this problem by gradually shifting towards the participatory budgeting model, in which the citizens of a country are directly involved in the decisions regarding the allocation of tax revenues to public expenditures. We can learn from the example of South Korea, which follows the participatory budgeting model. In 2020, the Korean Government approved 38 public projects, which were proposed by the citizens. These projects targeted youth unemployment, childcare support, small businesses and socially marginalized communities. The Government of Pakistan can allocate a fixed amount for similar participatory initiatives. This will help in building trust in the government by ensuring that the taxes are being utilized effectively to improve living standards.

In addition, some measures need to be implemented to increase the tax revenue from the undertaxed agricultural sector. Unless the relevant provincial bodies and agricultural stakeholders are incentivized to increase their tax contributions, digitization and formalization efforts will be extremely difficult. The federal and provincial governments can collaborate on an agreement to allocate a fixed proportion of agricultural tax revenue to agricultural projects. The Union Cabinet of India has allocated Rs 13,966 for agricultural research and sustainable agricultural practices.

Effective penalties for non-compliance are crucial. It would be interesting to assess how well the outlined penalties in the FA are executed. Without addressing systematic loopholes, these reforms will not result in significant progress.

The establishment of the Tax Fraud Investigation Wing is a step in the right direction, but its effectiveness will depend on its transparency and the ability to withstand the pressure from powerful and influential lobbying groups who are involved in tax evasion.

Rabia Khan is a Teaching Fellow at Department of Economics, LUMS.

Yushma Umar is a Teaching Fellow at Department of Economics, LUMS.

Mahbub ul Haq Research Centre at LUMS

Postal Address

LUMS

Sector U, DHA

Lahore Cantt, 54792, Pakistan

Office Hours

Mon. to Fri., 8:30 a.m. to 5:00 p.m.